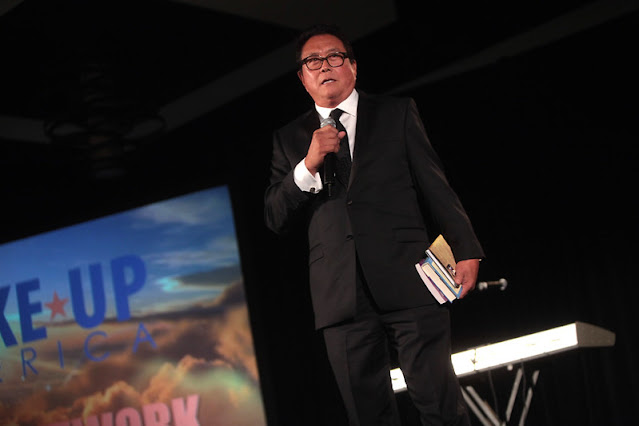

Robert Kiyosaki's Top 6 Passive Income Investments for 2023

"Discover Robert Kiyosaki's top 6 passive income investments for 2023 and unlock financial freedom today!"

Unlock the Secret to Making Money While You Sleep: Robert Kiyosaki's Top 6 Passive Income Investments for 2023! Do you long for a life free from financial concerns because you're sick of the daily grind? Imagine being free to follow your interests without being restricted by a standard 9 to 5 employment.

Passive income, or money that comes in without you having to work for it, is the key to achieving this goal. To help you increase your income in 2023, we'll examine famous author Robert Kiyosaki's most recent insights and his top six suggestions for cash-flowing investments in this post.

Knowledge of Passive Income

It's important to understand what passive income is and why it's so significant before diving into the realm of cash-flowing investments. Making money while you sleep, vacation, or spend time with loved ones is possible with passive income, which you earn without actively working for it.

Passive income, according to Robert Kiyosaki, author of the well-known book "Rich Dad Poor Dad," is essential to accumulating wealth and reaching financial freedom.

In his most recent book, "The Capitalist Code," Kiyosaki stresses the value of developing several passive income streams as opposed to relying simply on your job to provide for your financial stability. He also supports purchasing assets that generate cash flow as opposed to those that just increase in value.

Top 6 Assets with Cash Flow for Passive Income

The top six cash-flowing assets that can assist you in generating passive income in 2023 are as follows:

1. Real estate

One of the best investments for passive income, according to Kiyosaki, is real estate. It provides a consistent income stream that can support your way of life and gradually increase your wealth. In high-growth regions, Kiyosaki advises making investments in commercial real estate, rental properties, and real estate investment trusts (REITs).

2. Dividend Stocks

Investing in dividend stocks is a wonderful strategy to create income flow. A portion of the company's profits are paid to you as dividends when you purchase stocks that pay dividends. Without having to sell your shares, this offers a reliable income source.

3. Business ventures

Establishing a company that can run without regular oversight from you can provide passive revenue. Selling electronic books, online classes, or other digital goods may fall under this category. As an alternative, you can invest as a passive investor in other people's enterprises.

4. Intellectual Property (IP)

If you have valuable concepts, innovations, or artistic creations, you can legally safeguard them and generate passive revenue through IP. Patents, trademarks, copyrights, and trade secrets might all fall under this category. Your IP may be licensed or franchised to generate a consistent flow of passive income.

5. Peer-to-Peer Lending

Platforms for peer-to-peer lending connect investors and borrowers, giving you the opportunity to generate passive income through interest payments. You can create a consistent stream of passive income by lending money to people and small businesses, potentially with better rates than conventional savings accounts or bonds.

6. Annuities

In retirement, annuities can offer a guaranteed source of passive income. They function as a contract between you and an insurance provider, where you provide payments in return for consistent payouts in the future. However, it's crucial to take into account the possible dangers and costs related to annuities.

In conclusion, generating passive income is a potent approach to increase your current income and secure your financial future. You can develop a sustainable source of income that protects you from economic uncertainty by diversifying your portfolio with cash-flowing assets.

Do your homework, talk to financial professionals, and carefully consider the risks and rewards of each investment. You may create a consistent income stream that enables you to live life on your terms with time, effort, and a sound financial plan.