Crypto Funds Have Biggest Outflows in 12 Weeks

"Crypto funds had the biggest week of outflows in 3 months as negative sentiment pervades digital-asset markets following the collapse of Sam FTX."

Buy the Dip, Sell the Bounce: Crypto Funds Have Biggest Outflows in 12 Weeks

Crypto finances had the largest week of outflows in 3 months as terrible sentiment pervades digital-asset markets following the fall apart of Sam Bankman-Fried’s FTX exchange, and the contagion to different firms.

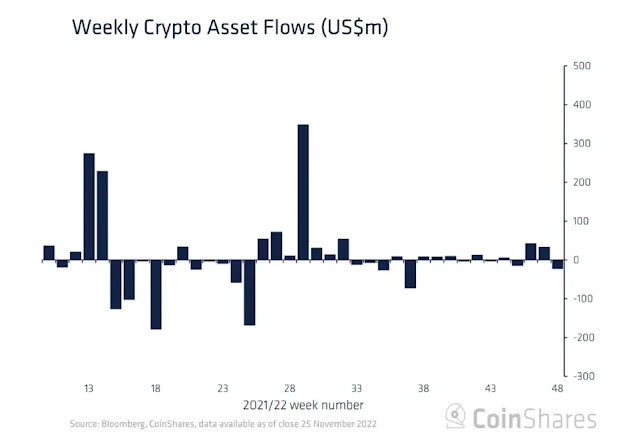

Outflows for crypto funding merchandise totaled $23 million, the very best quantity in 12 weeks and a reversal from a two-week streak of inflows, in step with a report via way of means of CoinShares on Monday.

Investors had scooped up stocks in digital-asset finances as crypto charges tanked withinside the weeks after FTX’s meltdown, however as charges stabilized remaining week the fashion seems to have reversed.

The headline parent for outflows is even extra bearish than it appears due to the fact the week protected some $9.2 million of inflows into “quick bitcoin” finances, or the ones designed to take advantage of in addition rate declines in the most important cryptocurrency via way of means of marketplace value.

The outflows are nonetheless small in comparison to a spate of some $two hundred million of redemptions in advance this 12 months, after the financial disaster of the crypto lender Celsius Network.

Bitcoin outflows

Outflows from bitcoin (BTC) finances totaled $10 million.

Even with the 65% rate decline in BTC 12 months to date, the most important cryptocurrency via way of means of marketplace capitalization has nonetheless netted $322 million of inflows in 2022.

“Regionally, the terrible sentiment turned into targeted at the U.S., Sweden and Canada, which all noticed both outflows from lengthy funding merchandise or inflows into quick merchandise,” stated James Butterfill, head of studies at CoinShares. “Germany and Switzerland stood out as buyers in aggregate, introduced to lengthy most effective or bought out of quick positions.”

Total asset beneathneath management (AUM) in digital-asset finances dropped to a brand new two-12 months low of $22.2 billion, in large part due to this 12 months’s steep rate declines.

source: finance.yahoo.com/news/buy-dip-sell-bounce-crypto-183727034.html